Tariala Tokenomics

Background

Companies struggle to trade with one another because of centralised processes with burdensome financing parties that are inefficient and expensive. By utilising DeFi processes, we are truly democratising global trade, allowing the small farmer in Pakistan to trade with the farmer in Nigeria at a reasonable cost.

Bitcoin provided the opportunity to send value to anyone anywhere in the world without an intermediary. Tariala builds further upon that vision by providing the infrastructure to bring trust to international parties trading without the need for intermediaries.

Proposition

The international payments market is fraught with risks of non-payment. Letter of Credit transactions are used to intermediate between parties and to provide a level of assurance to counterparties that delivery will take place before funds are released. Banks are currently the centralised parties of trust for these transactions, based on a history of reputation in ensuring security and trust.

These products are often costly and present issues when managing this in a smaller environment. Fundamentally, we find that costs are prohibitive and can cost as much as 5-8% for a Letter of Credit for smaller transactions.

Institutions and processes have been slow to adopt the latest technology, rendering processing and access to finance expensive and complicated.

This can be resolved with smart contracts. By ensuring that funds are only released when the party has shipped the goods or when the buyer has confirmed that the goods have been received, we can demonstrate a way of maintaining custody of the funds bringing security to both parties.

Goal and Vision

Ultimately, the vision is to bring Real World Assets (RWA) to DeFi and tap into the ~$1tn of locked value in Bitcoin.

We begin with trade finance, which typically has regular payment cycles and additionally demonstrates low default rates.

In future, we plan to bring other real world assets such as mortgages and salary financing to DeFi, though we are not limited to these.

Introducing the TAL token

The TAL token is that native protocol token to Tariala. It is to be used for a variety of purposes as seen below:

We have opted to structure the risk participation and insurance model as a mutual instead of as an insurance company. We can then ensure greater cost efficiencies and further reduce the overall risk to participants of the protocol, thereby reducing the cost to the insured parties.

This also helps alleviate the agency issue by ensuring that all who participate in the protocol have a vested interest in the sustainability and ongoing nature of the protocol.

Subscribing to the TAL token will require a KYC check to ensure compliance with international regulations. Participants from the US, UK and Australia will need to be deemed “accredited investors” as per the regional regulations.

Incentives

Token holders will benefit from accrued value from value of:

- The revenues of the protocol e.g. share of lending and insurance fees

- Later the additional yield generated from high-quality returns generated from premiums invested in order to generate a return

- Token holders will benefit from a fixed percent of lifetime earnings of referred borrowers and lenders on the protocol. Should any defaults on the part of the borrower occur revenue share will cease to continue for the defaulted borrower.

TAL Token Whitelist

The first 15k Discord members will be automatically whitelisted for participation in the TAL token sale (pending KYC).

Additionally, some portion of these 15k Discord members will receive an airdropped TAL token upon submission of their wallet address and completion of KYC.

Allocation

Early and future team including community managers e.g. discord, twitter promotions - 30%

- Community - 20%

- Treasury and market making - 25%

- Early supporters - 15%

- Auditors - 3%

- Underwriters - 3%

- Claims Assessors - 3%

- DAO Governance participation - 1%

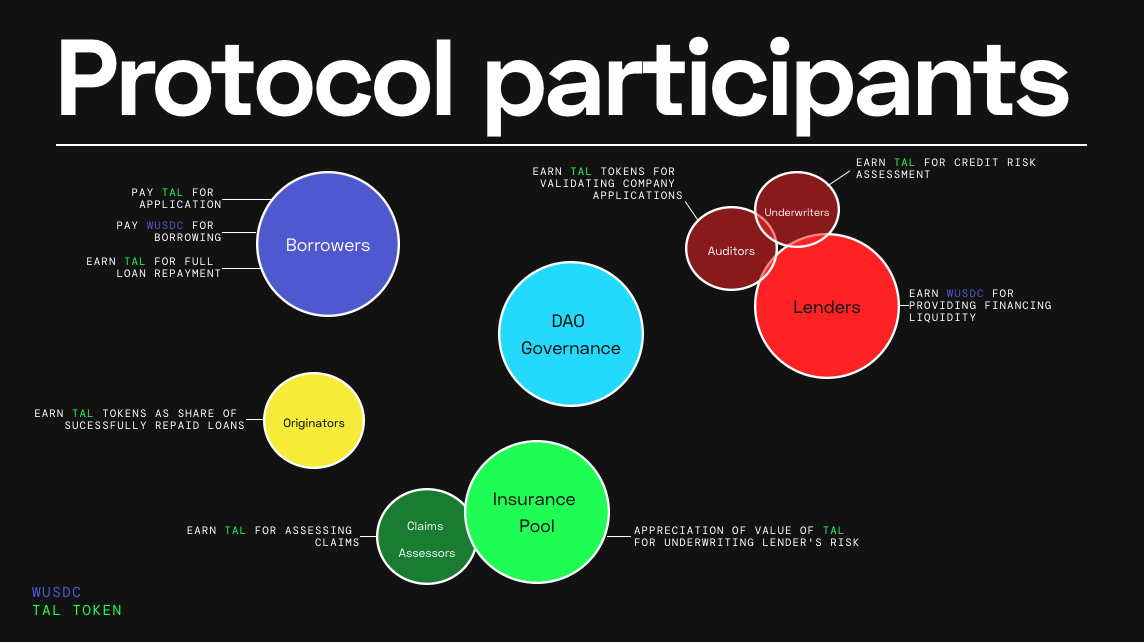

Protocol Participant Archetypes:

- Auditors: assess the authenticity of the company applying for financing

- Underwriters: apply a credit risk assessment to the company and transaction

- Borrowers: borrow funds against real world transactions from the protocol

- Lenders: lend funds against real world transactions from the protocol

- DAO Governance board representatives:

- 7 out of 15 multi-sig with members representing the various participants in the protocol:

- Auditors

- Underwriters

- Borrowers

- Lenders

- TAL Token holders i.e. insurance capital

- 7 out of 15 multi-sig with members representing the various participants in the protocol:

- Insurance: underwrite the risk of the Lenders thereby offering a stable return

Emissions

Emissions will be flat at first but we will allow for the DAO to vote on adding emissions if the demand is there.

Vesting Schedule

Early team that have been active and involved already for some time will have their vesting schedule retrospectively dated

Early team tokens and private sale tokens will have a linear vesting period over 48 months with a 12-month cliff

DAO Governance

The protocol is to be governed as a DAO. Holders of tokens will be able to vote on and opt for changes once the initial product is launched so as not to constrain the development time of the product in the earliest phase.

- DAO Charter

- Regular reporting systems

Quadratic Voting

- Weighting DAO votes by the square root of the amount of tokens used to vote

- Will ensure that smaller holders are heard and can influence vote results

- Prevents outsized influence from larger holders

- By doing so, it address majority rule problems

- E.g. supply one vote to an issue will cost 1 token, however, applying 4 votes to an issue will cost 16 votes